Introduction:

Silver, often referred to as the “poor man’s gold,” has captivated traders and investors alike with its unique properties and potential for profitable opportunities. In this blog post, we will delve into the exciting world of silver trading, exploring why it deserves a place in your investment portfolio and uncovering the strategies and tools you need to succeed.

- The Allure of Silver:

Silver possesses exceptional characteristics that make it a valuable asset in various industries. With its high electrical and thermal conductivity, silver plays a crucial role in technology, solar energy, and healthcare sectors. The increasing demand for silver in these industries creates a strong foundation for its market price and opens doors for lucrative trading prospects. - Diverse Trading Options:

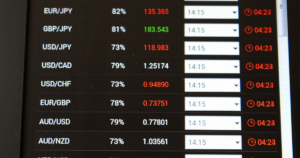

When it comes to trading silver, you have a range of options to choose from. Whether you prefer physical trading, futures contracts, CFDs, options, or ETFs, each method offers unique advantages tailored to different trading preferences and risk appetites. By understanding the intricacies of each trading instrument, you can optimize your trading strategy and maximize your potential returns. - Profit from Market Volatility:

Silver’s historical price movements have exhibited significant volatility, making it an attractive choice for traders seeking profit opportunities. With clear support and resistance levels, extended trends, and tradeable price moves, silver presents an environment ripe for generating profits. By leveraging technical analysis and employing prudent risk management, you can capitalize on these price fluctuations and enhance your trading performance. - The Relationship Between Silver and Gold:

Silver and gold have shared a long-standing relationship within the precious metals market. Understanding the dynamics of their correlation and the gold/silver ratio can provide valuable insights into trading strategies. By analyzing the ratio and identifying potential price disparities, you can seize opportunities to profit from the relative movements of these two precious metals. - Risk and Reward Considerations:

Like any investment, silver trading comes with its own set of pros and cons. On one hand, silver’s liquidity, technical predictability, and multiple trading options offer a wealth of advantages. On the other hand, the absence of a direct economic calendar and the complex fundamentals of silver require traders to stay updated on market trends and adapt their strategies accordingly. By carefully weighing these factors, you can make informed decisions and mitigate potential risks.

Conclusion:

Silver trading provides a gateway to an exciting and dynamic market, offering numerous opportunities for traders to profit. Its unique properties, versatility in trading instruments, and historical price movements make it an enticing asset for both beginners and experienced traders. By understanding the fundamentals of silver trading, leveraging technical analysis, and staying informed about market trends, you can unlock the potential of silver and embark on a rewarding trading journey.

Remember, successful trading requires continuous learning, adaptability, and disciplined risk management. So, take the plunge into silver trading armed with knowledge, and let the shimmer of this precious metal illuminate your path to financial success.