Introduction To The My Forex Funds Scandal

In the fast-paced world of forex trading, trust and integrity are paramount. However, there are unfortunate instances where deceit and fraud tarnish the industry’s reputation. One such case that sent shockwaves through the trading world is the My Forex Funds scandal. This blog post aims to provide a comprehensive analysis of the scandal, shedding light on the allegations, key players involved, and the impact it had on prop trading. By delving into this cautionary tale, traders can gain valuable insights into the importance of due diligence and vigilance in the forex market.

Understanding My Forex Funds’ Scandal Case

1.1 What is Retail Forex Trading?

Before delving into the scandal, it is essential to grasp the fundamentals of retail forex trading. Forex, short for “foreign exchange,” refers to the global marketplace for buying and selling currencies. Retail forex trading involves individual investors who participate in currency trading with the hope of profiting from exchange rate fluctuations.

1.2 The Role of the CFTC

The Commodity Futures Trading Commission (CFTC) is pivotal in ensuring transparency and fairness in the commodities and futures markets. When fraudulent practices come to light, such as in the case of My Forex Funds, the CFTC steps in to investigate and, if necessary, take legal action.

1.3 Who is Murtuza Kazmi?

At the center of the My Forex Funds scandal is Murtuza Kazmi. Operating primarily from New Jersey, USA, Kazmi ran companies under the Traders Global Group Inc. umbrella, doing business as My Forex Funds. While limited information is publicly available about Kazmi, numerous allegations have emerged, painting a picture of deceit and mismanagement.

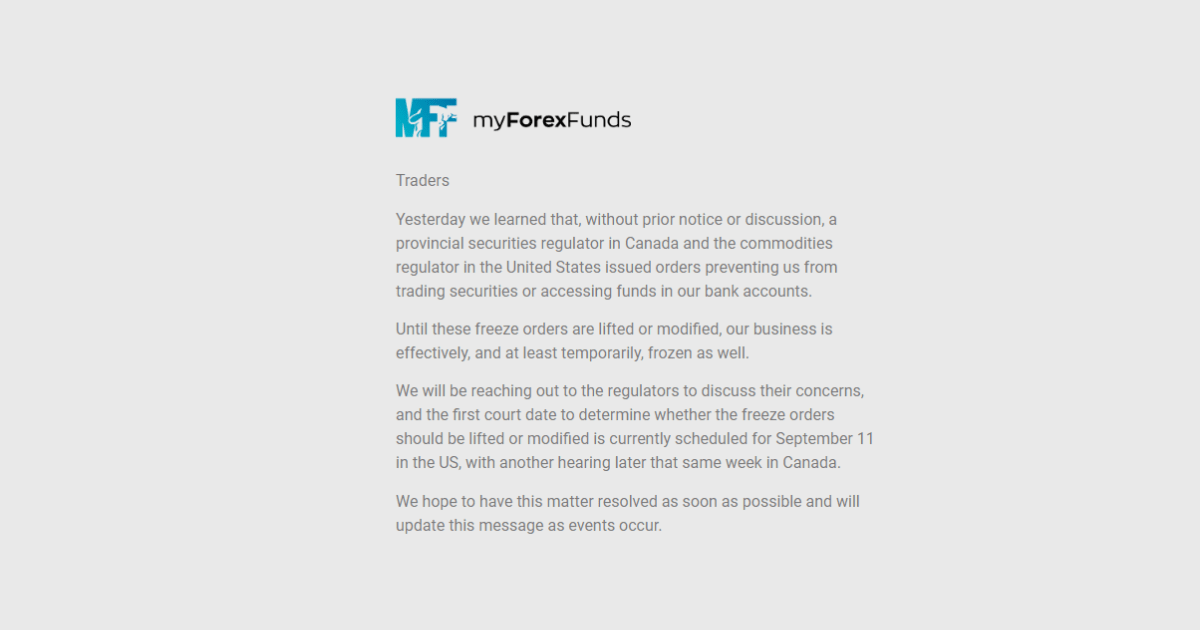

Allegations and Fraudulent Practices

2.1 The Specific Accusations

The CFTC filed a formal complaint against My Forex Funds, accusing the company of fraudulent solicitation. This allegation implies that the company deceived customers to obtain their funds. Shockingly, the amount involved in this case surpasses $300 million, making it a substantial fraud scheme.

2.2 Misleading Promises

My Forex Funds employed a marketing strategy that promised potential traders the opportunity to become “professional traders” using the company’s funds. The enticing slogan, “your success is our business,” instilled a false sense of security among customers. However, the CFTC alleges that these promises were far from reality.

2.3 The Counterparty Sham

In forex trading, a counterparty refers to the entity that takes the opposite position in a trade. My Forex Funds claimed that trades were conducted against third-party “liquidity providers,” indicating transparency and fairness. However, the CFTC alleges that Traders Global Group Inc., rather than a neutral third party, acted as the counterparty in most transactions, creating an inherent conflict of interest.

2.4 Unfair Practices Unveiled

The allegations against My Forex Funds extend beyond mere deception. The company is accused of abruptly terminating customer accounts, providing various pretexts to retain earnings for themselves. Additionally, they stand accused of executing customer orders at unfavorable prices and charging hidden commissions that erode traders’ profits.

My Forex Funds Scandal – The Impact

3.1 The Scope of the My Forex Funds Scandal

The magnitude of the My Forex Funds scandal is staggering, with over 135,000 customers falling victim to the scheme. These individuals, driven by dreams of financial success in forex trading, unknowingly contributed over $310 million in fees.

3.2 Where Did the Money Go?

Allegations suggest that Murtuza Kazmi did not simply amass ill-gotten gains. Instead, he indulged in a lavish lifestyle, purchasing luxury homes and cars while transferring tens of millions of dollars into personal accounts. Meanwhile, countless traders struggled to comprehend the extent of the fraud and recover their lost funds.

3.3 Repercussions for Prop Trading

The My Forex Funds scandal sent shockwaves through the prop trading community, highlighting the importance of thorough due diligence. It served as a stark reminder that even seemingly reputable companies can engage in fraudulent practices. The incident prompted regulatory bodies and industry participants to reassess risk management practices and tighten regulations to protect traders from similar schemes in the future.

Conclusion – My Forex Funds Scandal

The My Forex Funds scandal stands as a sobering lesson in forex trading, underscoring the need for caution and vigilance. Traders must exercise due diligence, thoroughly researching and verifying the legitimacy of companies before entrusting them with their funds. By learning from this cautionary tale, individuals can navigate the forex market with greater awareness and protect themselves from falling victim to fraudulent schemes.