Introduction:

Trading 212 is a popular online brokerage platform that offers a range of trading services to investors. In this comprehensive guide, we will delve into the benefits and regulations associated with Trading 212 as an ESMA (European Securities and Markets Authority) broker. We will explore the regulatory framework, investor protections, leverage limitations, and other important factors that traders should consider when using Trading 212.

2.1 Regulation and Registration Details:

Trading 212 operates under the business name Trading 212 Markets Ltd. and obtained its registration from CySEC on 01/03/2021. As an ESMA broker, Trading 212 is authorized to operate within the European Union, providing traders with a safe and regulated trading environment.

Investor Protections and Benefits:

Trading 212, as an ESMA-regulated broker, offers several investor protections and benefits. These include compliance with ESMA laws and regulations, adherence to European Regulations, segregated bank accounts, maximum leverage limitations, negative balance protection, restrictions on spread betting and binary options, and the absence of forex bonuses.

3.1 Compliance with ESMA Laws and Regulations:

ESMA brokers like Trading 212 are required to follow stringent rules and regulations set by ESMA to protect traders. Compliance ensures that the broker operates transparently, with fair trading practices and investor safeguards in place.

3.2 European Regulation: CySEC:

Trading 212 is regulated by CySEC, which is one of the prominent regulatory bodies in Europe. The CySEC regulation ensures that Trading 212 adheres to the highest standards of financial conduct, providing investors with confidence and trust in the platform.

3.3 Segregated Bank Accounts:

Trading 212 offers segregated bank accounts, which means that client funds are kept separate from the broker’s operational funds. This segregation provides an additional layer of protection for traders, as their funds are safeguarded in the event of any financial difficulties faced by the broker.

3.4 Maximum Leverage on Forex:

As an ESMA broker, Trading 212 operates with specific leverage limitations. The maximum leverage on major forex pairs is set at 1:30 within all ESMA countries. This limitation aims to protect traders from excessive risk and potential losses.

3.5 Negative Balance Protection:

Trading 212 provides negative balance protection, ensuring that traders cannot lose more than their deposited funds. In volatile market conditions, this feature shields traders from owing additional money to the broker, thereby mitigating the risk of substantial financial losses.

3.6 Restrictions on Spread Betting and Binary Options:

ESMA regulation prohibits spread betting in most countries and bans binary options trading in all EU countries. Trading 212 complies with these restrictions, ensuring that traders are protected from the inherent risks associated with these speculative instruments.

3.7 No Forex Bonuses:

As an ESMA-regulated broker, Trading 212 does not offer forex bonuses or deposit bonuses. This regulation prevents traders from being enticed by promotional offers that may increase their risk exposure.

Leverage Differences and Features of Trading 212:

Understanding the leverage differences and features of Trading 212 is crucial for traders. By examining these aspects, traders can make informed decisions and manage their risk effectively.

4.1 Leverage Limitations within ESMA Countries:

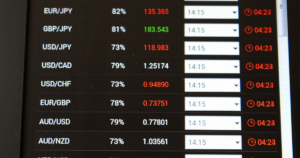

Trading 212, as an ESMA-regulated broker, adheres to the leverage limitations set by ESMA. Within all ESMA countries, the maximum leverage on major forex pairs is capped at 1:30 for retail traders. This limitation aims to protect traders from excessive leverage, which can amplify both potential profits and losses.

4.2 Benefits of Negative Balance Protection:

One of the key benefits of Trading 212 as an ESMA broker is the provision of negative balance protection. This means that traders cannot lose more money than they have deposited into their trading accounts. In highly volatile market conditions or during unexpected market events, this feature ensures that traders’ account balances do not go into negative territory, safeguarding them from substantial financial liabilities.

4.3 Segregated Accounts for Enhanced Safety:

Trading 212 offers segregated bank accounts, which is another important feature for trader safety. With segregated accounts, client funds are kept separate from the broker’s own operational funds. This segregation ensures that even in the unlikely event of the broker’s insolvency, traders’ funds remain protected and can be returned to them.

Trading 212 as an ESMA Broker:

To verify the ESMA regulation of Trading 212, traders can visit the Trading 212 website directly. It is essential to conduct due diligence and ensure that the broker’s regulatory coverage aligns with the information provided.

5.1 Timeline of Trading 212 as an ESMA Broker:

Trading 212 obtained its registration with CySEC as an ESMA broker on 01/03/2021. This means that since that date, Trading 212 has been operating under the ESMA regulatory framework, providing traders with the associated benefits and protections.

5.2 Verifying ESMA Regulation:

Traders can verify Trading 212’s ESMA regulation by checking the broker’s registration details, including the regulatory authority and the registration number. Additionally, they can visit the official website of the regulatory body, in this case, CySEC, to confirm Trading 212’s regulatory standing.

Conclusion:

Trading 212, as an ESMA-regulated broker, offers various benefits and protections to traders. These include compliance with ESMA laws and regulations, adherence to European regulation, segregated bank accounts, limited leverage on forex pairs, negative balance protection, and restrictions on spread betting and binary options. By operating within the ESMA regulatory framework, Trading 212 aims to provide a secure and transparent trading environment for investors.

Frequently Asked Questions (FAQs):

Q1: What is ESMA?

Q2: What are the benefits of Trading 212 being an ESMA-regulated broker?

Q3: How can I verify Trading 212’s ESMA regulation?

Q4: Does Trading 212 offer forex bonuses?

Q5: What leverage limitations does Trading 212 adhere to?

Key Takeaways:

- ESMA regulation ensures that Trading 212 operates transparently and provides investor protections.

- Trading 212 is an ESMA-regulated broker, authorized by CySEC.

- The broker offers benefits such as compliance with ESMA laws, segregated bank accounts, limited leverage, negative balance protection, and restrictions on spread betting and binary options.

- Traders can verify Trading 212’s ESMA regulation by checking the registration details and visiting the official website of the regulatory authority.