Introduction

Forex trading is a dynamic and complex field that requires a deep understanding of both psychology and mathematics. While many novice traders focus solely on technical analysis and indicators, seasoned traders understand that success in the forex market goes beyond charts and numbers. It involves mastering self-control, making sound psychological decisions, and employing mathematical calculations to assess risk and probability. In this article, we will delve into the intricate relationship between psychology and mathematics in forex trading, exploring the importance of control, calculations, and the key factors that contribute to success in this challenging realm.

Psychology in Forex Trading

One of the critical aspects of forex trading is recognizing and managing psychological factors. While technical analysis and indicators provide valuable insights, they are not the sole determinants of success. Emotions such as fear, greed, and impatience can significantly impact trading decisions and outcomes. Therefore, developing self-control and emotional resilience are vital for navigating the forex market successfully. Traders must accept that losses are an inherent part of trading and be mentally prepared to withstand them. Adopting a disciplined approach and sticking to a well-defined trading plan can help traders maintain psychological stability and make rational decisions even in volatile market conditions.

The Illusion of Control

The concept of control in forex trading is intriguing. Traders often seek a sense of control and predictability, but the reality is that the market is influenced by numerous unpredictable factors. While traders can analyze historical data, identify trends, and employ various strategies, they cannot accurately predict market movements with certainty. However, the illusion of control in forex can be beneficial, as it allows traders to feel confident in their decision-making process and maintain discipline. It is essential to strike a balance between acknowledging the uncertainty inherent in trading and utilizing effective risk management techniques.

Mathematics and Probability Calculation

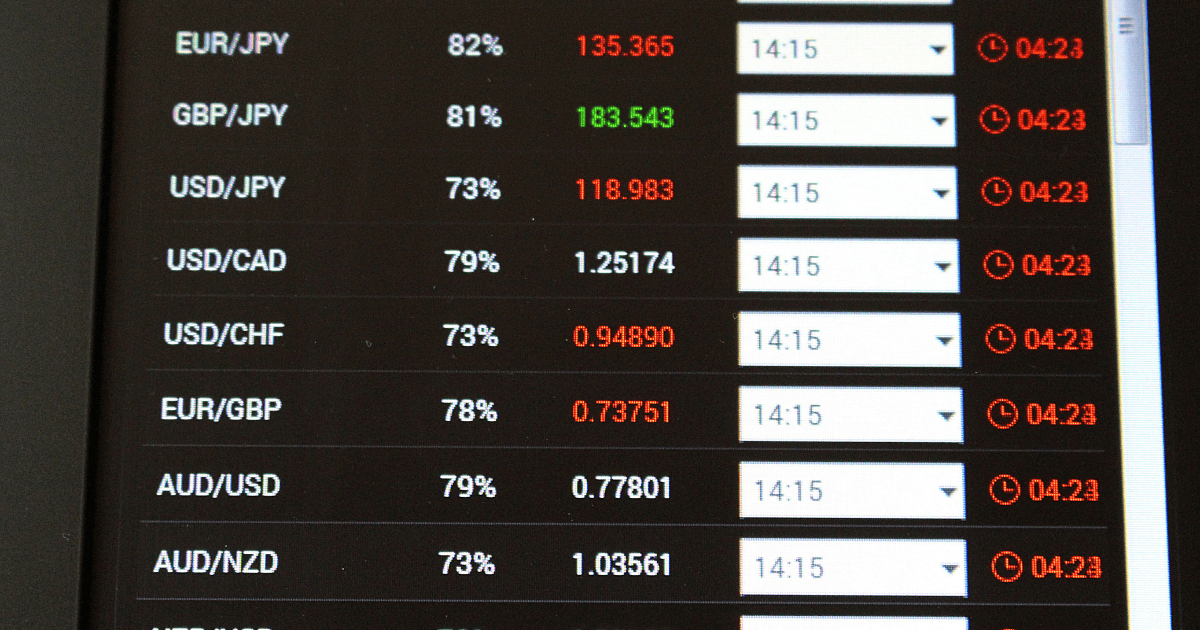

Mathematics plays a crucial role in forex trading as traders employ various calculations and probability assessments to make informed decisions. Understanding risk-reward ratios, position sizing, and probability analysis enables traders to assess the potential profitability of a trade and manage risk effectively. By considering factors such as support and resistance levels, trend lines, and market patterns, traders can identify strategic entry and exit points, increasing their chances of success. However, it is important to note that mathematical calculations are not infallible predictors of market outcomes. They serve as tools to assist traders in making informed decisions based on historical patterns and statistical probabilities.

Risk Management and Emotional Discipline

Successful forex trading requires a comprehensive risk management strategy. Traders must define their risk tolerance, set appropriate stop-loss and take-profit levels, and adhere to strict money management principles. Emotional discipline plays a significant role in risk management, as impulsive decisions driven by fear or greed can lead to substantial losses. By maintaining a disciplined approach, traders can minimize emotional biases and make rational decisions based on their trading plan and market analysis. Implementing risk management techniques, such as trailing stops, can also help protect profits and limit potential losses.

Key Takeaways

- Forex trading involves a complex interplay between psychology and mathematics.

- Psychological factors, such as emotional control and discipline, are crucial for success in forex trading.

- The illusion of control in forex can provide traders with confidence, but it is essential to acknowledge the inherent uncertainty of the market.

- Mathematics and probability calculations assist traders in assessing risk, identifying entry and exit points, and managing positions effectively.

- Risk management and emotional discipline are essential components of a successful trading strategy.

Commonly Asked Questions

Q1: Can forex trading guarantee consistent profits?

A: Forex trading does not offer guaranteed profits. It is a dynamic and unpredictable market, and success depends on various factors, including skill, knowledge, discipline, and market conditions.

Q2: How can I control my emotions while trading forex?

A: Developing emotional discipline requires self-awareness, practice, and a well-defined trading plan. Techniques such as meditation, journaling, and setting realistic expectations can help manage emotions effectively.

Q3: Are mathematical calculations infallible in predicting market movements?

A: Mathematical calculations provide tools for assessing probabilities and making informed decisions, but they are not foolproof predictors of market outcomes. They should be used in conjunction with other forms of analysis.

Q4: What is the role of risk management in forex trading?

A: Risk management is crucial in forex trading to protect capital and minimizelosses. It involves setting appropriate stop-loss levels, defining risk tolerance, and employing position sizing techniques to manage exposure effectively.

In conclusion, mastering the interplay between psychology and mathematics is essential for success in forex trading. Traders must develop emotional discipline, acknowledge the illusion of control, and utilize mathematical calculations to assess risk and probability. By combining these elements with a robust risk management strategy, traders can navigate the forex market with confidence and increase their chances of achieving consistent profitability.