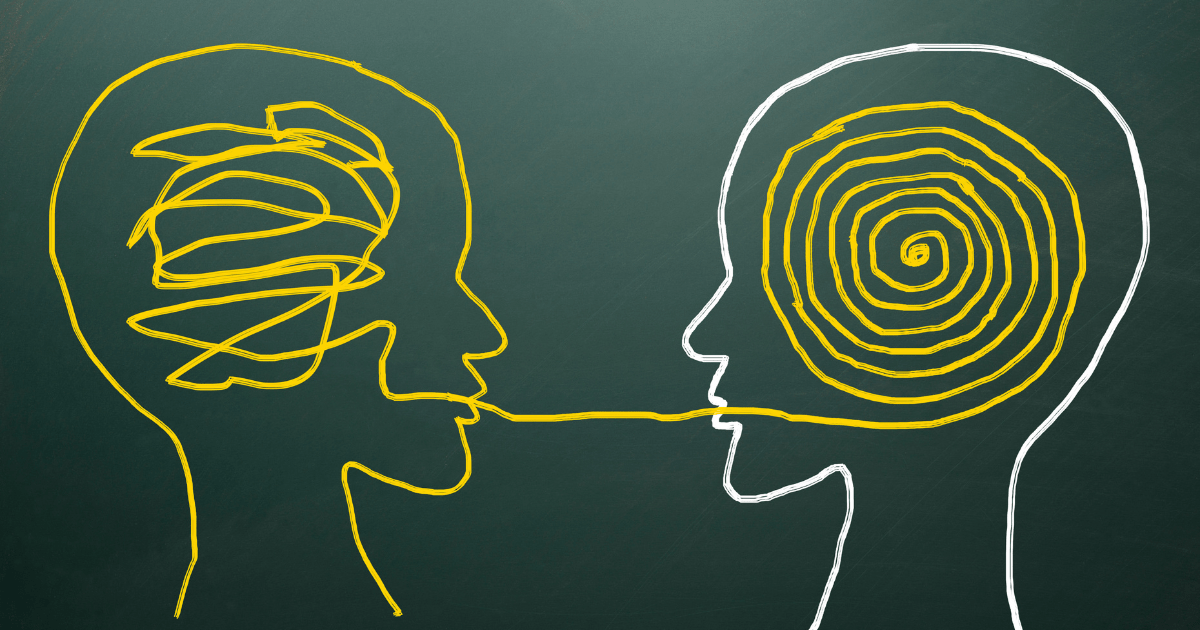

Many aspiring traders focus solely on acquiring technical knowledge and perfecting their strategies. However, they often overlook a critical aspect of trading success: psychology. Understanding and managing your emotions, mindset, and behavior is paramount to achieving long-term profitability and personal growth in the trading world.

Lesson 1: Setting Realistic Expectations

One common pitfall for beginner traders is the tendency to set unrealistic financial goals and expect overnight success. It is important to recognize that trading is a journey that requires time, dedication, and continuous learning. Instead of focusing solely on short-term gains, adopt a long-term perspective. By setting achievable goals and committing to steady progress, you pave the way for sustainable success and financial freedom in the future.

Lesson 2: Embracing Personal Development

Trading is not just about acquiring technical skills; it is a personal development journey. Successful traders understand the importance of self-reflection and self-improvement. They identify their weaknesses and work on overcoming them. By addressing psychological barriers such as fear, overtrading, or an inability to accept losses, traders can develop resilience, discipline, and emotional control. This journey of self-discovery and growth is essential for long-term success in the markets.

Lesson 3: Acceptance and Self-Awareness

To overcome psychological hurdles, traders must first acknowledge their imperfections and limitations. Recognize that mistakes are part of the learning process and embrace them as opportunities for growth. Develop self-awareness by observing your emotions, thoughts, and behaviors while trading. By identifying patterns and triggers, you can effectively manage your reactions and make more rational decisions. Acceptance of oneself and a commitment to personal growth lay the foundation for a successful trading mindset.

Lesson 4: Taking Action and Seeking Solutions

Acknowledging flaws is only the first step; taking action is what sets successful traders apart. Once you identify areas that require improvement, develop strategies and tactics to overcome them. This may involve implementing risk management techniques, sticking to a trading plan, or seeking professional help, such as working with a trading coach or therapist. By actively seeking solutions and committing to change, traders can break free from self-sabotaging patterns and enhance their trading performance.

Lesson 5: The Power of Trading Psychology

Mastering trading psychology not only improves your trading results but also extends its benefits to other areas of your life. As you gain self-confidence, discipline, and emotional resilience, you will witness positive changes in your personal life as well. The introspection and self-awareness cultivated through trading psychology will empower you to make better decisions, handle challenges effectively, and achieve personal fulfillment beyond the trading realm.

Key Takeaways:

- Set realistic expectations and adopt a long-term perspective for trading success.

- Embrace personal development and address psychological barriers to enhance trading performance.

- Cultivate self-awareness by observing and managing your emotions, thoughts, and behaviors.

- Take action to overcome weaknesses and seek solutions through risk management and professional guidance.

- Mastering trading psychology not only benefits your trading but also leads to personal growth and fulfillment.

Frequently Asked Questions:

Q1: Can mastering trading psychology guarantee consistent profits?

A: While mastering trading psychology is essential for long-term success, it does not guarantee consistent profits. Trading involves inherent risks, and profitability depends on various factors, including market conditions, strategy effectiveness, and risk management. However, by developing a strong psychological foundation, traders can improve their decision-making, manage emotions, and increase their overall chances of success.

Q2: How can I improve my trading psychology?

A: Improving trading psychology requires self-reflection, self-awareness, and a commitment to personal growth. Some strategies include journaling to track emotions and behaviors, practicing mindfulness and meditation to cultivate emotional resilience, seeking professional guidance through trading coaches or therapists, and continuously educating yourself about trading psychology principles.

Q3: Is trading psychology applicable to all types of trading?

A: Yes, trading psychology is applicable to all types of trading, including forex, stocks, commodities, and cryptocurrencies. The principles of managing emotions, maintaining discipline, and making rational decisions are universal and can be applied to any trading market.

Q4: How long does it take to master trading psychology?

A: Mastering trading psychology is an ongoing process that varies from individual to individual. Itdepends on factors such as prior psychological resilience, dedication to personal development, and the ability to implement learned strategies effectively. It is important to approach trading psychology as a lifelong journey rather than expecting immediate mastery.

In conclusion, mastering trading psychology is a crucial aspect of achieving long-term success and personal growth in the trading world. By setting realistic expectations, embracing personal development, cultivating self-awareness, taking action, and seeking solutions, traders can enhance their decision-making process and develop the psychological resilience necessary to navigate the challenges of trading. While trading psychology does not guarantee consistent profits, it significantly improves the odds of success and extends its benefits to other areas of life. By integrating these principles into your trading journey, you can unlock your full potential and embark on a path of self-actualization and prosperity.

References:

[1] Trading Psychology 101: A Complete Guide to Self-Actualization and Prosperity | Forex Academy. (URL: https://www.forex.academy/trading-psychology-101-a-complete-guide-to-self-actualization-and-prosperity/)