Introduction

The MetaTrader platform has revolutionized the world of forex trading, offering powerful tools and features that have made it a favorite among traders worldwide. Whether you’re a beginner or an experienced trader, understanding how to make the most of the MetaTrader platform can significantly enhance your trading experience and improve your trading outcomes. In this comprehensive guide, we will delve into the various aspects of the MetaTrader platform, exploring its tools, indicators, functionalities, and customization options. By the end of this guide, you will have a solid understanding of how to optimize your trading returns using the MetaTrader platform.

MetaTrader Tools and Features

The MetaTrader platform, available in versions MT4 and MT5, offers a range of tools and features that cater to the diverse needs of traders. Let’s explore some of the key tools and features available in MetaTrader:

1. Indicators

Indicators are indispensable tools for technical analysis, helping traders identify trends, potential entry and exit points, and market conditions. MetaTrader provides a wide range of built-in indicators, including oscillators, trend indicators, volume indicators, and Bill Williams indicators. Traders can access these indicators through the platform’s user-friendly interface and apply them to their charts to gain valuable insights into market dynamics.

2. Customizability

One of the significant advantages of MetaTrader is its high level of customizability. Traders can personalize their trading experience by adding custom indicators, modifying chart settings, and applying various visual styles. The platform allows you to create bespoke charts and indicators, giving you the flexibility to tailor your trading environment to your preferences.

3. Automated Trading

MetaTrader also provides a robust framework for automated trading through its expert advisors (EAs) and trading robots. Traders can develop or download EAs that execute trades based on predefined rules and strategies, eliminating the need for manual intervention. This feature enables traders to take advantage of algorithmic trading and optimize their trading strategies.

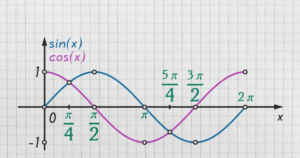

Understanding MetaTrader Indicators

Indicators play a crucial role in technical analysis, helping traders identify potential trading opportunities and make informed decisions. Let’s take a closer look at some of the commonly used MetaTrader indicators:

1. Oscillator Indicators

Oscillator indicators, such as the Relative Strength Index (RSI) and Stochastic Oscillator, help identify overbought or oversold conditions in the market. Traders can adjust the parameters of these indicators to suit their trading strategies and preferences.

2. Trend Indicators

Trend indicators, like Bollinger Bands and Moving Averages, assist traders in identifying the direction and strength of market trends. By analyzing price movements and patterns, these indicators can provide valuable insights into potential trend reversals or continuations.

3. Volume Indicators

Volume indicators, such as the Money Flow Index (MFI) and On Balance Volume (OBV), help traders gauge the strength of price movements by analyzing trading volumes. High volume accompanied by price changes can indicate the presence of significant market interest and validate trading signals.

4. Bill Williams Indicators

Bill Williams’s indicators, including the Alligator and Fractals, are based on chaos theory and offer unique perspectives on market dynamics. These indicators can help traders identify emerging trends, determine market momentum, and spot potential reversals.

Customizing and Installing Indicators

MetaTrader provides traders with the flexibility to customize their trading environment by installing additional indicators. Here’s a step-by-step guide on how to install custom indicators in MetaTrader:

1. Accessing Indicator Files

To install custom indicators, navigate to the “File” menu on the top toolbar of MetaTrader. Open the dropdown list and click on “Open Data Folder.” This action will open the folder containing indicator files.

2. Adding Custom Indicators

Once you have accessed the indicator files, locate the desired indicator file and drag it into the “Indicator” folder. Afterward, restart the MetaTrader platform to ensure the newly installed indicator is recognized.

3. Applying Custom Indicators

To apply the custom indicator to a price chart, click on “Insert,” then “Indicators,” and finally “Custom.” Select the newly installed indicator from the list and adjust its parameters according to your requirements. Click “OK” to apply the indicator to the chart.

Tips for Maximizing the Use of MetaTrader Tools and Indicators

While MetaTrader offers a plethora of tools and indicators, it’s essential to use them effectively to maximize trading returns. Here are some tips to consider:

1. Combine Indicators

Combining multiple indicators can provide more robust trading signals. For example, using the Bollinger Bands alongside the Relative Strength Index (RSI) canhelp identify potential trend reversals when price reaches the upper or lower bands and the RSI indicates overbought or oversold conditions.

2. Backtest and Optimize Strategies

Before applying indicators and tools to live trading, it’s crucial to backtest and optimize your trading strategies. MetaTrader provides a built-in strategy tester that allows you to test your strategies using historical data. By analyzing past performance, you can fine-tune your strategies and increase the likelihood of success in live trading.

3. Stay Informed and Educated

The forex market is dynamic and constantly evolving. To stay ahead, it’s important to stay informed about market news, economic events, and changes in market conditions. Additionally, continue to educate yourself about different trading strategies, risk management techniques, and new developments in the forex industry. MetaTrader offers a wealth of educational resources, including trading guides and tutorials, to help you expand your knowledge and make more informed trading decisions.

Common Queries About MetaTrader

1. Is MetaTrader suitable for beginners?

Yes, MetaTrader is suitable for beginners. The platform offers a user-friendly interface, comprehensive charting tools, and a wide range of educational resources. Beginners can start by familiarizing themselves with the basic features and gradually explore more advanced tools and indicators as they gain experience.

2. Can I use MetaTrader on mobile devices?

Yes, MetaTrader is available as a mobile application for both iOS and Android devices. This allows traders to access their trading accounts, monitor the markets, and execute trades on the go. The mobile version of MetaTrader provides a seamless trading experience, enabling you to stay connected to the markets at all times.

3. Can I automate my trading strategies with MetaTrader?

Yes, MetaTrader offers robust automation capabilities through expert advisors (EAs) and trading robots. Traders can develop or download EAs that execute trades based on predefined rules and conditions. Automated trading can help eliminate emotional biases and improve the efficiency of trade execution.

Key Takeaways

- The MetaTrader platform is a powerful tool for forex trading, offering a wide range of features, tools, and indicators.

- Customization options in MetaTrader allow traders to personalize their trading environment and adapt it to their preferences.

- Understanding and effectively using indicators such as oscillators, trend indicators, volume indicators, and Bill Williams indicators can enhance trading decisions.

- Installing custom indicators in MetaTrader expands the range of tools available for analysis and decision-making.

- Tips for maximizing the use of MetaTrader tools include combining indicators, backtesting strategies, and staying informed about market developments.

- MetaTrader is suitable for beginners and offers mobile applications for trading on the go.

- Automation capabilities through expert advisors and trading robots enable traders to implement automated trading strategies.

Mastering the MetaTrader platform requires practice, continuous learning, and refining trading strategies. By leveraging the platform’s tools and features effectively, traders can gain a competitive edge in the forex market and improve their overall trading performance.