The New York forex session, also known as the New York trading session, is a key period in forex trading that offers numerous opportunities to traders. This session is the second-most liquid session and overlaps with the London session, making it the most liquid period of the day. It is open from 8am-5pm (ET), with the overlap occurring between 8am and 12pm (ET), which is a time of increased volatility.

During the overlap, traders can utilize a breakout strategy to take advantage of the heightened volatility. As London closes for the day, volatility tends to decrease, and traders can switch to a range trading strategy to capitalize on support and resistance levels. It is crucial to understand the best time to trade forex and adapt your trading strategy accordingly.

Key Takeaways:

- The New York forex session offers numerous opportunities for traders.

- The session is the second-most liquid and overlaps with the London session.

- The overlap period between 8am and 12pm (ET) is characterized by increased volatility.

- Traders can use a breakout strategy during the overlap and a range trading strategy after the London session closes.

- The best forex pairs to trade during the New York session are the majors, such as EUR/USD, USD/JPY, GBP/USD, EUR/JPY, GBP/JPY, and USD/CHF.

By understanding the forex market hours and adapting your trading strategy to align with the New York session, you can maximize profitability while minimizing risks. Stay updated on news releases, consider session overlaps, and adjust your risk management strategy accordingly. Mastering the New York session is a crucial step towards achieving success in forex trading.

Trading Strategies for the New-York Session

To trade the New York session effectively, it is crucial to employ proven strategies that take advantage of specific market conditions and opportunities. During the overlap with the London session, which occurs between 8am and 12pm (ET), volatility tends to increase, providing traders with breakout opportunities. One effective strategy is to use breakouts to capitalize on the price momentum during this time. By identifying key support and resistance levels, traders can enter positions when the price breaks above or below these levels, anticipating further price movement in the same direction.

Another strategy to consider during the New York session is range trading. As London closes for the day, volatility tends to decrease, and the market often enters into a consolidation phase. Traders can take advantage of this by identifying support and resistance levels that contain price within a range. By buying at support and selling at resistance, traders can profit from the price oscillations within the range.

When trading the New York session, it is essential to focus on USD currency pairs. The most popular currency pairs during this session include EUR/USD, USD/JPY, GBP/USD, EUR/JPY, GBP/JPY, and USD/CHF. These pairs offer high liquidity and are influenced by important economic data releases and news events. Traders should closely monitor key economic indicators, such as non-farm payrolls, GDP reports, and central bank announcements, as they can significantly impact the price movement of these currency pairs during the New York session.

To increase the chances of success, traders should adapt their strategies according to the active trading session. Utilizing forex tools, such as economic calendars and news feeds, can help traders stay updated on important news releases and events that may affect the market. Additionally, considering session overlaps, such as the London-New York overlap, can provide valuable trading opportunities. Traders should adjust their risk management strategy accordingly, taking into account the increased volatility during the overlap and employing appropriate stop-loss and take-profit levels.

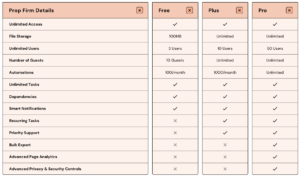

Trading Strategies for the New-York Session

| Trading Strategy | Time of Day | Key Considerations |

|---|---|---|

| Breakout Strategy | 8am-12pm (ET) | Identify support and resistance levels. Enter positions when the price breaks above or below these levels. |

| Range Trading | After 12pm (ET) | Identify support and resistance levels that contain price within a range. Buy at support and sell at resistance. |

By mastering trading strategies for the New York session and adapting to market conditions, traders can enhance profitability and minimize risks. It is important to stay informed about key economic indicators, utilize appropriate forex tools, and manage risk effectively. With a strategic approach, traders can make the most of the opportunities presented during this highly liquid and active session.

Adapting to the New-York Session and Conclusion

Adapting your trading approach to the New York session is vital for success in the forex market. As the second-most liquid session, it presents numerous opportunities for traders to profit. To maximize gains and minimize risks during this session, it is crucial to employ effective strategies and tools.

Firstly, traders should focus on session overlaps. The New York session overlaps with the London session, resulting in increased market volatility. During the overlap period from 8am to 12pm (ET), breakout strategies can be utilized to take advantage of the heightened volatility. By identifying key support and resistance levels, traders can place trades that capitalize on the momentum.

Additionally, trading the major currency pairs during the New York session can lead to profitable outcomes. Pairs such as EUR/USD, USD/JPY, GBP/USD, EUR/JPY, GBP/JPY, and USD/CHF are known for their liquidity and volatility during this session. Traders should closely monitor these pairs and adapt their strategies accordingly to capitalize on market movements.

In order to stay updated on market news and economic indicators, utilizing forex tools is essential. These tools provide real-time data on factors that impact currency values, helping traders make informed decisions. By staying informed about economic releases and news events, traders can adjust their risk management strategies effectively and minimize potential losses.

| Key Takeaways |

|---|

| Adapting your trading approach to the New York session is vital for success in the forex market. |

| During the New York-London session overlap, breakout strategies can be used to take advantage of heightened volatility. |

| Trading major currency pairs, such as EUR/USD and USD/JPY, can offer profitable opportunities during the New York session. |

| Utilizing forex tools to stay updated on market news and economic releases is crucial for informed decision-making. |

| By adapting to the New York session and employing effective risk management strategies, traders can enhance profitability and minimize risks. |

Conclusion

Mastering the New York session is essential for any forex trader looking to maximize profits and minimize risks. As the second-most liquid session that overlaps with the highly active London session, the New York session offers ample opportunities for traders in the forex market. With its operating hours from 8am to 5pm (ET), the session’s peak period of volatility occurs between 8am and 12pm (ET). This heightened volatility can be effectively capitalized upon by employing a breakout strategy.

During the overlap between the London and New York sessions, traders can take advantage of the increased volatility by identifying and trading breakouts. As the London session comes to a close, the market tends to stabilize, and traders can shift their strategy to focus on range trading. This involves identifying support and resistance levels and making trades within those boundaries.

When trading during the New York session, it is advisable to concentrate on major forex pairs, including EUR/USD, USD/JPY, GBP/USD, EUR/JPY, GBP/JPY, and USD/CHF. These pairs tend to exhibit higher liquidity and tighter spreads, ensuring better trade execution and minimizing slippage.

Adapting your trading strategy to align with the active trading sessions is crucial. Utilizing forex tools to stay updated on news releases can help you make informed trading decisions. Additionally, considering session overlaps and adjusting your risk management strategy accordingly is essential for maintaining profitability and minimizing risks.

By understanding the dynamics of the New York session and its overlaps with other sessions, traders can enhance their trading skills and achieve greater success in the forex market. Mastering the New York session requires careful analysis, adaptability, and effective use of available resources. So, make sure to invest time and effort in mastering the New York session for a more rewarding trading experience.

FAQ

Q: What is the New York forex session?

A: The New York forex session is the second-most liquid session that overlaps with the London session, making it the most liquid period of the day.

Q: What are the trading strategies for the New York session?

A: Traders can use a breakout strategy during the overlap between the New York and London sessions to take advantage of increased volatility. As London closes for the day, traders can use a range trading strategy to take advantage of support and resistance levels.

Q: Which forex pairs are the best to trade during the New York session?

A: The best forex pairs to trade during the New York session are the majors, such as EUR/USD, USD/JPY, GBP/USD, EUR/JPY, GBP/JPY, and USD/CHF.

Q: How can I adapt my trading strategy to the New York session?

A: To adapt your trading strategy to the New York session, it is important to align with the active trading sessions, use forex tools to stay updated on news releases, and consider session overlaps to adjust your risk management strategy accordingly.

Q: How can mastering forex trading sessions enhance profitability and minimize risks?

A: By mastering forex trading sessions and understanding time zone differences, traders can effectively time their trades, take advantage of increased volatility, and minimize risks associated with trading in less liquid sessions.