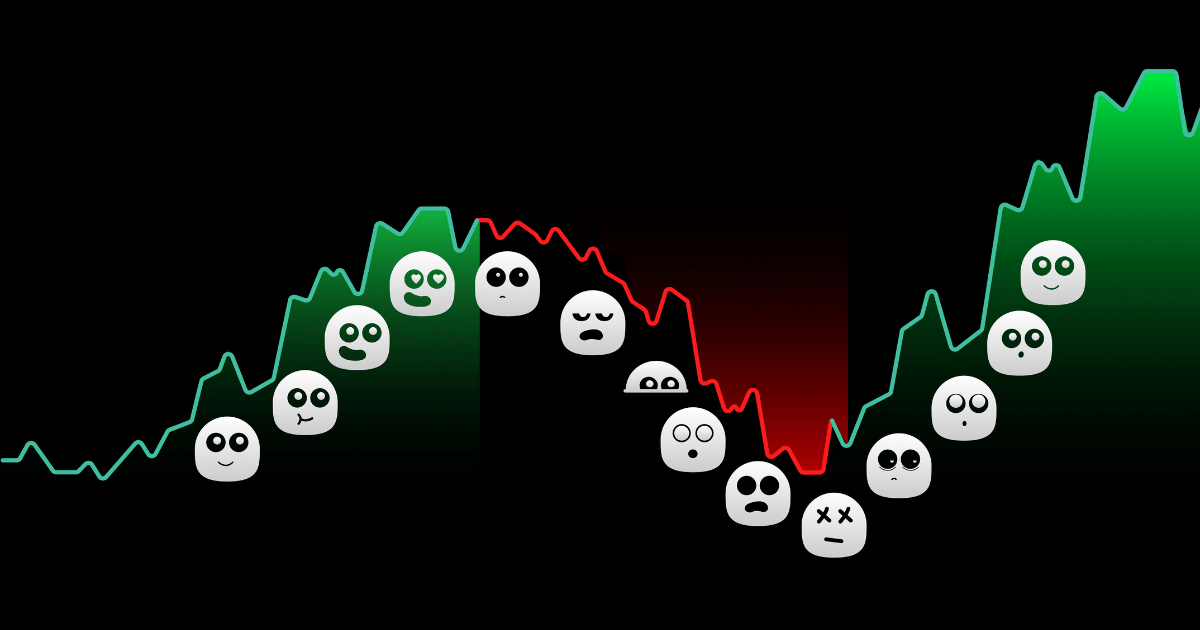

Trading in financial markets is not just about numbers and charts; it also involves navigating through a complex world of emotions. Emotions can significantly impact trading decisions and ultimately determine whether one emerges as a successful trader or a disheartened loser. Recognizing the importance of emotions in long-term trading is crucial. In this article, we will delve into the significance of emotions in trading, explore the shortcomings of traditional market theories, discuss strategies for managing emotions, and provide key takeaways for achieving success in long-term trading.

The Role of Emotions in Trading:

Emotions play a pivotal role in trading, often influencing decision-making processes. Fear and greed are two dominant emotions that traders must contend with. Fear can lead to missed opportunities and hasty exits, while greed can result in excessive risk-taking. Successful traders understand the importance of striking a balance between these emotions and maintaining a disciplined approach to trading.

Shortcomings of Traditional Market Theories:

Traditional market theories, such as the efficient market hypothesis, have long dominated the field of finance. However, these theories often fail to consider the impact of human emotions on market behavior. The efficient market hypothesis assumes that markets are perfectly efficient and reflect all available information. This assumption overlooks the influence of trading costs, information asymmetries, and the irrational behavior of market participants. Behavioral finance emerged as a revolutionary field that acknowledged the role of emotions in shaping market dynamics, highlighting the limitations of traditional theories.

Managing Emotions for Trading Success:

Strategies for managing emotions include:

- Self-awareness: Recognize and acknowledge your emotions while trading. Understand how fear and greed may impact your decision-making process.

- Emotional discipline: Develop a trading plan and stick to it. Implement risk management strategies, such as setting stop-loss orders, to mitigate impulsive actions driven by emotions.

- Mindfulness and self-control: Practice mindfulness techniques, such as meditation and yoga, to cultivate inner peace and maintain focus during volatile market conditions. Exercise self-control to avoid reacting impulsively to market fluctuations.

- Psychological well-being: Take care of your overall well-being, both physically and mentally. Maintain a healthy lifestyle, get adequate sleep, and ensure a balanced diet. A sound mind and body contribute to better decision-making.

- Continuous learning: Invest time in understanding your own trading patterns and biases. Analyze past trades, learn from mistakes, and continuously improve your trading strategy. This self-reflection aids in minimizing emotional biases and enhancing trading performance.

Key Takeaways:

- Emotions significantly impact trading decisions and outcomes. Recognizing and managing emotions is crucial for long-term trading success.

- Traditional market theories often overlook the influence of human emotions on market behavior. Behavioral finance provides valuable insights into the role of emotions in shaping market dynamics.

- Achieving success in long-term trading requires striking a balance between fear and greed, maintaining discipline, and adhering to a well-defined trading plan.

Frequently Asked Questions:

Q1: How do emotions affect trading performance?

A: Emotions can lead to impulsive and irrational decision-making, resulting in missed opportunities or excessive risk-taking. Managing emotions is essential to maintain a disciplined and rational approach to trading.

Q2: Can emotions be completely eliminated from trading?

A: Emotions are an inherent part of human nature and cannot be completely eliminated. However, they can be managed and controlled through self-awareness, mindfulness, and psychological well-being.

Q3: What role does self-reflection play in managing emotions?

A: Self-reflection allows traders to understand their own biases, learn from past mistakes, and refine their trading strategies.