Introduction:

Trading in the financial markets can be a rewarding endeavor, but it also carries inherent risks. To succeed as a trader, it is essential to have a well-defined and profitable trading plan. A trading plan serves as a roadmap that guides your decision-making process, allowing you to approach trades with confidence and discipline. In this comprehensive guide, we will delve into the key components of a profitable trading plan and provide insights that can significantly increase your chances of success.

What is a Trading Plan?

A trading plan is a systematic approach that traders use to navigate the complexities of the financial markets. It encompasses a set of strategies, rules, and guidelines that help traders make informed decisions. A well-structured trading plan includes elements such as entry and exit points, position sizing, risk management, and trade management. By adhering to a trading plan, you can mitigate impulsive decisions that often lead to losses and improve your overall profitability.

The Benefits of Having a Trading Plan:

Focus and Discipline: A trading plan provides you with a clear focus and ensures that you stick to your predetermined strategies. It helps you avoid emotional trading and impulsive decision-making, which can be detrimental to your success.

Performance Evaluation: A comprehensive trading plan allows for thorough performance evaluation. By keeping detailed records of your trades, including entry and exit points, targets, and reasons for entering a trade, you can identify patterns and learn from past mistakes. This evaluation process empowers you to refine your strategies and improve your future trading sessions.

Decision-Making Process: Following a trading plan enables you to make objective decisions based on predetermined criteria. It reduces the likelihood of impulsive choices and helps you evaluate potential trades more effectively.

Confidence and Stability: A trading plan instills confidence in your trading abilities, as you have a well-defined strategy to rely on during market fluctuations. It provides stability and eliminates the need for constant second-guessing, allowing you to stay focused on your long-term goals.

Developing a Profitable Trading Plan:

Mental Preparation: Preparing yourself mentally before trading is often overlooked but crucial. Ensure you are well-rested and in a positive emotional state to face the challenges of the market.

Determine Your Risk Tolerance: Assess your risk tolerance, considering how much you are willing to risk on a single trade. Set a predetermined limit for losses, and if that limit is exceeded, exit the market until you are ready to re-enter with a new strategy.

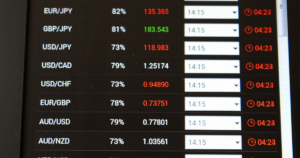

Set Entry and Exit Points: Never enter a trade without a plan. Analyze the market conditions and determine when to enter and exit a trade. If the situation does not align with your plan, be disciplined enough to cancel the trade and wait for a better opportunity.

Set Realistic Goals: Before entering a trade, establish realistic profit targets and risk/reward ratios. Define the minimum risk/reward ratio you are willing to accept. Set weekly, monthly, and annual profit goals as a percentage of your portfolio and regularly reassess them.

Conduct Research: Stay informed about market events and news. Before the market opens, research the global markets and economic indicators. Make a list of relevant data releases and decide whether to trade before or after the release. Patience and preparation can help you avoid unnecessary risks during volatile market reactions.

Keep Accurate Records: Successful traders maintain detailed records of their trades. Include information such as entry and exit points, targets, and reasons for entering a trade. Additionally, document the reasons for any losing trades to identify patterns and avoid repeating mistakes.

Conclusion:

Creating a profitable trading plan is crucial for success in the financial markets. A well-designed trading plan provides guidance, minimizes risks, and enhances profitability. It encompasses various components, including mental preparation, risk tolerance assessment, setting realistic goals, conducting thorough research, and maintaining accurate records. By implementing these steps and consistently adhering to your trading plan, you can boost your confidence, discipline, and ultimately achieve profitability in your trading endeavors.

Frequently Asked Questions:

How long should a trading plan be?

A trading plan should be comprehensive but concise. It should outline your strategies, rules, and guidelines in a clear and easily understandable manner. While the length may vary, aim for a document that covers all essential aspects without unnecessary complexity.

Can a trading plan be modified?

Yes, a trading plan can be modified as needed. It isimportant to regularly review and update your trading plan to reflect changes in your trading style, market conditions, and personal goals. However, avoid making frequent and impulsive changes that may undermine the stability of your plan.

Should I seek professional guidance when creating a trading plan?

Seeking professional guidance can be beneficial, especially for novice traders. Experienced traders or trading mentors can provide valuable insights and help you develop a trading plan tailored to your individual circumstances. However, always exercise caution and conduct thorough research when choosing a mentor or professional advisor.

How long does it take to develop a profitable trading plan?

The time it takes to develop a profitable trading plan varies from person to person. It depends on factors such as your prior knowledge of the markets, your understanding of trading strategies, and the amount of time you can dedicate to learning and practicing. Developing a solid trading plan requires patience, persistence, and continuous learning. It is an ongoing process that evolves as you gain experience and refine your strategies.

Can a trading plan guarantee profits?

While a well-designed trading plan can significantly increase your chances of success, it does not guarantee profits. The financial markets are inherently unpredictable, and there will always be an element of risk involved in trading. A trading plan helps you manage and mitigate risks, make informed decisions, and improve your overall profitability. However, it is important to remember that losses are a part of trading, and no plan can eliminate them entirely.

Should I backtest my trading plan?

Backtesting your trading plan involves applying your strategies and rules to historical market data to assess their effectiveness. It can provide insights into how your plan would have performed in the past. Backtesting can be a valuable tool for evaluating and refining your trading plan. However, it is important to note that past performance does not guarantee future results. Market conditions can change, and it is crucial to adapt your plan accordingly.

Remember, creating a profitable trading plan requires dedication, discipline, and continuous learning. It is essential to stay informed, adapt to changing market conditions, and regularly evaluate and refine your plan to increase your chances of long-term success.