In the world of Forex trading, there are various terms and concepts that traders need to be familiar with in order to navigate the market effectively. One such term is “cable,” which holds a significant role in Forex trading involving the British pound sterling (GBP) and the US dollar (USD). In this blog post, we will delve into the definition of cable, its historical background, and how it is used in the Forex market.

What is Cable in Forex?

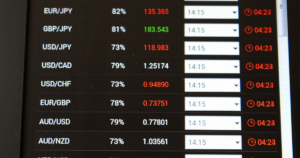

Cable, in the context of Forex trading, refers to the exchange rate between the British pound sterling (GBP) and the US dollar (USD). This term originated from the telegraph cables that were historically used to transmit exchange rates and other financial information between London and New York. Today, cable represents the GBP/USD currency pair and is widely followed by traders in the Forex market.

Understanding the Significance of Cable

The GBP/USD currency pair holds great significance in the Forex market due to the economic and political influence of both the United Kingdom and the United States. As two major global economies, any fluctuations in their exchange rate can have a substantial impact on international trade, investments, and financial markets.

Traders closely monitor cable as it provides insights into the relative strength or weakness of the GBP compared to the USD. Movements in the cable can be influenced by a wide range of factors, including economic indicators, geopolitical events, central bank policies, and market sentiment.

How is Cable Used in Forex Trading?

Cable is widely used by Forex traders for various trading strategies and analysis. Here are a few ways in which cable is utilized:

1. Technical Analysis:

Traders use technical analysis tools and chart patterns to identify trends, support and resistance levels, and potential entry and exit points in their cable trading strategies. They analyze historical price data, indicators, and oscillators to make informed trading decisions.

2. Fundamental Analysis:

Traders examine economic indicators, such as GDP, inflation rates, interest rates, employment data, and geopolitical developments, to assess the fundamental strength or weakness of the GBP and the USD. This analysis helps them anticipate potential market moves and adjust their positions accordingly.

3. Carry Trades:

Carry trading involves borrowing a currency with a low-interest rate to invest in a currency with a higher interest rate. Traders may use cable as part of their carry trading strategy, taking advantage of interest rate differentials between the GBP and the USD.

4. Risk Management:

Cable can also be used as a hedging tool to manage currency risks. Traders with exposure to GBP or USD in their portfolios can use cable positions to offset potential losses caused by adverse exchange rate movements.

Conclusion

Cable plays a crucial role in Forex trading, representing the exchange rate between the British pound sterling and the US dollar. Understanding cable and its significance empowers traders to make informed decisions and capitalize on opportunities in the Forex market. By utilizing technical and fundamental analysis techniques, traders can develop effective strategies to navigate the dynamics of cable trading.

Disclaimer: Trading Forex involves significant risk and may not be suitable for all investors. The information provided in this blog post is for educational purposes only and should not be considered as financial or investment advice. Always conduct thorough research and seek professional guidance before engaging in Forex trading.